As the Lincoln property market shifts, more homeowners are facing the decision of when and by how much to adjust their asking prices. The choice can feel difficult, but in today’s climate, it is often the difference between attracting a buyer or sitting unsold for months.

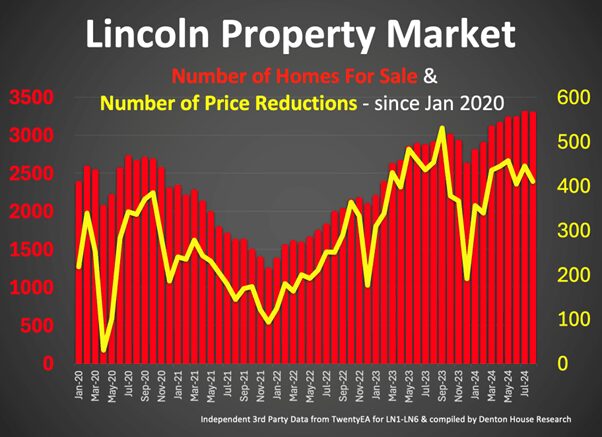

The supply of homes for sale in Lincoln has climbed sharply, from 1,977 in August 2022 to 3,412 in August 2025. With more stock now available across LN1-LN6, the competition for buyers’ attention is far greater. That makes smart pricing, and particularly smart price adjustments, more critical than ever.

Making the Most of Property Portal Price Bands

One of the simplest yet most overlooked strategies in selling your home is to utilise the price bands on Rightmove, Zoopla, and OnTheMarket to your advantage. These portals group properties into price search brackets, and buyers almost always filter by them. Aligning your asking price with a band means your home appears in more searches and is visible to more potential buyers. For example, listing at £400,000 instead of £399,950 places the property in both the £375,000 to £400,000 range and the £400,000 to £425,000 range. That single adjustment could double the audience for your Lincoln home.

How Much to Reduce to Trigger Portal Alerts

When it comes to reductions, the percentage matters. To reappear in Rightmove and OnTheMarket’s email alerts to buyers, you need to reduce your price by at least 2%. On Zoopla, the threshold is 3%, so anything below this will make your reduction invisible to the most active buyers, who rely on these updates.

The Current Lincoln Numbers

It is no surprise that many Lincoln people feel reductions are happening more often than they used to. The numbers back this up. In 2022 there were, on average, 228 price reductions each month in the Lincoln area. Today, that figure has more than doubled to 475 per month.

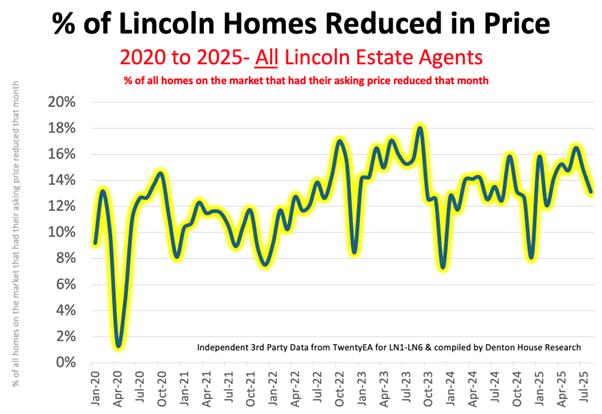

Yet, interestingly, the proportion of reductions has stayed broadly stable over time. On average, 1 in every 8.1 homes in Lincoln, or 12.4%, sees a price cut each month. This has been consistent over the past five and a half years, despite a sharp rise in the total stock of homes for sale.

The Lesson for Lincoln Homeowners

More homes on the market inevitably means more reductions. However, the consistent percentage indicates that the real issue is not the market itself, but rather how properties are priced at the outset. Starting with a realistic figure not only gives you a better chance of receiving early offers, but it also reduces the need for painful cuts later and helps your home stand out in a crowded Lincoln marketplace.

Looking at the annual trend in Lincoln…

- In 2020, an average of 10.2% of the 2,487 Lincoln properties for sale each month had their asking prices reduced.

- In 2021, an average of 10.5% of the 1,805 Lincoln properties for sale each month had their asking prices reduced.

- In 2022, an average of 12.4% of the 1,801 Lincoln properties for sale each month had their asking prices reduced.

- In 2023, an average of 14.5% of the 2,729 Lincoln properties for sale each month had their asking prices reduced.

- In 2024, an average of 12.9% of the 3,120 Lincoln properties for sale each month had their asking prices reduced.

- In 2025, an average of 14.6% of the 3,261 Lincoln properties for sale each month had their asking prices reduced.

The Ideal Pricing Strategy for Lincoln Homes

The way you set your asking price at the start has a significant impact on both the speed and success of your sale. Lincoln homes that come onto the market overpriced usually sit unsold for longer and then require bigger reductions to tempt buyers. Even if they eventually go under offer, the odds of getting all the way through to exchange and completion are much lower.

Independent research from Denton House Research shows that UK properties sold stc within 25 days (therefore they were realistically priced) had a 94% success rate of subsequently reaching completion, compared with only a 56% chance for those that took more than 100 days to secure a sale/buyer.

Starting with a realistic figure gives you the best chance of attracting early offers, avoiding significant price cuts, and seeing the sale through to the end.

Lincoln homeowners who start with a higher asking price should always be ready to adjust swiftly. Acting within the first two to four weeks can keep your property from going stale. Leaving it for two to four months often reduces your chances of achieving a quick and successful sale.

Six Things Lincoln Homeowners Should Consider When Reducing a Price

Feedback from Viewings

If buyers consistently say your Lincoln property feels overpriced, take note. Viewers rarely say this unless they genuinely believe it. Consistent feedback about the asking price is one of the clearest signals that an adjustment is overdue.

Market Saturation

Take a close look at how many Lincoln homes similar to yours are currently listed for sale. If you own a two-bedroom semi, compare it with other two-bedroom semis that are listed or, more importantly, those that have already been sold subject to contract. Ask yourself honestly, does your home stand out? Friends and family can also provide you with unfiltered feedback. If it doesn’t stand out, the simplest solution is often to re-position your price to be more competitive.

Seasonal Shifts

The Lincoln property market changes pace throughout the year. Spring and early summer tend to be busier, while November and December can slow considerably. If you are marketing during a quieter period, you may need to be more flexible with your pricing to maintain interest.

Plenty of Viewings But No Offers

Across the wider UK, it usually takes between eight and ten viewings to generate an offer. If your Lincoln home is receiving numerous viewings in the first month but still no offers, it usually means the price is deterring buyers. Many people do not like to accept what they perceive as an “insultingly low” offer, so they walk away. Bringing your asking price nearer to where buyers see value can spark those offers into life.

Low Offers on the Table

Buyers in Lincoln often start low to gauge the level of flexibility available. Sometimes it is due to broader market conditions, sometimes it is because of work they feel needs to be done, and sometimes it is just a negotiating tactic. Remember, a property is only worth what someone is willing to pay, not what you, or even your agent, think it is worth. If the gap between offers and your asking price is wide, a price correction may be needed to bridge that divide.

Little or No Early Interest

If your Lincoln property has been on the market for a few weeks and viewings are scarce, start by reviewing your photography and online presentation. If these are strong, then the price is almost certainly the issue. An early, well-timed reduction can reignite interest and stop your home from being overlooked.

Honest Advice Matters

The Lincoln property market is complex, and every home is unique. Sometimes what you need is an honest second opinion from someone who will tell you the truth, even if it is not what you want to hear.

Are you currently on the market in Lincoln and wondering about a price reduction? Or are you preparing to sell soon and want to avoid this situation altogether?

For a no-obligation consultation and a fresh perspective on your strategy, get in touch. Together, we can position your Lincoln home to attract the right buyers and achieve the result you are aiming for.

If you would like a chat about where you sit in the current market, do not hesitate to give me a call on 01522 512 513.

To ensure ALL our clients get the absolute best experience, and a total marketing strategy as unique as their homes, we only list twenty properties per month, our October and November market appraisal slots are now available to book, we ensure that you are always a name and not just a number, with Walters.