The typical first-time buyer home in Lincoln costs £130,328, which is a lot of money in anyone’s book.

For years, the housing affordability debate has been framed in terms of house prices compared to average incomes. That makes a neat headline, but it isn’t how first-time buyers think. When you are weighing up your first home in Lincoln, the question isn’t “how many times my salary is the house worth?”. It’s “what slice of our take-home pay will the mortgage swallow each month?”

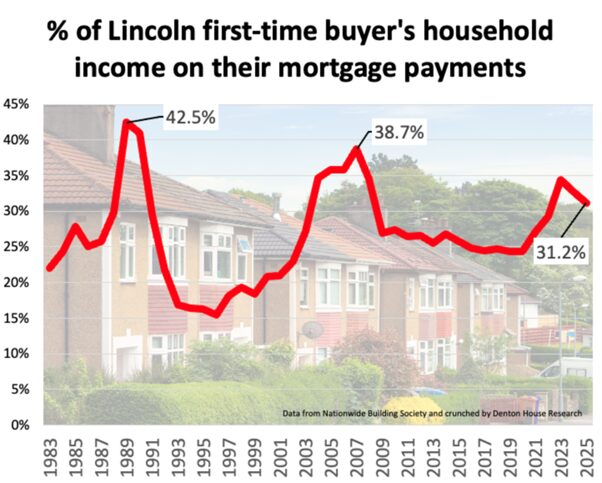

Looked at through that lens, the story for Lincoln first-time buyers is very different from the doom and gloom you often read. Yes, it is tough today, as mortgage payments take 31.2% of a Lincoln first-time buyer’s household income.

Yet, history shows there were periods when it was far tougher.

The late 1980s squeeze

Cast your mind back to the late 1980s. House prices were much lower in pound note terms, but interest rates were a punishing 14.4%. In 1989, first-time buyers in Lincoln were handing over 42.5% of their household income to cover mortgage payments (the national average was 47.2%). It was brutal.

The point is simple, Lincoln house prices were much lower at £31,897 in 1989, but the mortgage burden was far higher. Affordability, in the truest sense, was worse than today.

2007: déjà vu for new Lincoln first-time buyers

Fast-forward to the eve of the financial crisis. In 2007, first-time buyers in Lincoln had to commit 38.7% of their household income to their mortgage. Sound familiar? Another peak, another squeeze (the national average was 44.2%).

That number matters because it indicates that even in relatively recent history, affordability was worse than it is now. Today’s first-time buyers often tell the older generation that “it was easier in your day.” The numbers tell a completely different story.

The 2023 peak

Now, let’s talk about the recent pain. In 2023, the affordability rate in Lincoln reached 34.5% of the household income. That was the highest in over 15 years. Mortgage costs soared on the back of rising interest rates, and many first-time buyers put their plans on ice (the national average was 37.4%).

Yet, and this is crucial, even at the 2023 peak, it was still 10.9% proportionally cheaper than in 2007, and 18.8% more affordable than the late 1980s.

A glimmer of relief for Lincoln first-time buyers

Since 2023, the burden for Lincoln first-time buyers has started to ease. In 2024, the rate dropped to 32.6%, and by 2025, it had decreased to 31.2%. Still heavy, still demanding discipline, but trending in the right direction.

This shift tells us two things. First, the market is not static as the environment for first-time buyers moves year to year. Second, affordability must be measured not just in pounds on a price tag but as a living, breathing percentage of real household income.

The role of wages and inflation

The average UK home today is £34,400 cheaper than it was in 2022, once adjusted for inflation.

At first glance, that sounds impossible. Let me explain.

The average value of a UK home in 2022 was around £270,000.

However, in the last three years there has been inflation of 11.45%. Therefore, a British home that cost £270,000 in 2022 would need to be worth £304,400 in today’s money to stand still regarding inflation (to have the same spending power). The average UK house price today is £270,400 (just £400 more – or 0.15% more). That gap means the “real” value of a home has dropped by 11.3% – (i.e. 11.45% inflation less 0.15% house price growth makes 11.3%).

Put another way, UK homes are effectively 11.3% or £34,000 cheaper.

At the same time, UK headline wages are 16.28% higher since 2022. Take inflation off that wage rise (16.28% wage growth less 11.45% inflation) and real ‘after inflation’ wages are 4.83% higher since 2022. So while headline house prices in headline (nominal) terms have flatlined, buyers’ actual spending power has strengthened.

That combination is rare. Properties are 11.3% cheaper in real terms, and incomes are 4.83% higher in real terms. Add to that the fact that interest rates, while still not at the levels seen in the 2010s (and they never will be again), rates are beginning to edge down, and more homes are coming onto the market, and the balance has shifted. Buyers now have more choice, and crucially, more negotiating power.

This wider backdrop matters. Inflation has taken a significant bite out of family budgets, but unlike the late 1980s, wages have also been rising. That is why the proportion of income going on mortgage payments hasn’t rocketed back to the eyewatering levels we saw a generation ago.

Why the headline asking price of homes distracts us

A Lincoln starter home today looks eyewatering when you compare it with salaries. But the raw multiple of income to house price is a misleading way to judge affordability. What matters is whether the monthly mortgage outgoings are sustainable.

This perspective also explains why so many buyers do eventually take the plunge. A £150,000 headline asking price with a £185,000 mortgage may seem daunting, but a monthly payment of £745, once wages are factored in, can feel more achievable.

Peaks and troughs in perspective

History shows the journey is cyclical. There are peaks, there are troughs, and affordability is always more nuanced than the headlines suggest.

Final thought

Buying your first home in Lincoln will never be “easy.” It takes saving, sacrifice, and the courage to make a commitment. But don’t fall for the myth that it is uniquely impossible today. Previous generations faced even harsher affordability barriers, yet they still managed to climb the ladder.

Does this surprise you? Whether you are a parent advising your grown-up children or a first-time buyer yourself, the choice ultimately rests with you. Do you buy now, or wait? Tell us your stories and thoughts on when you purchased your Lincoln house, and what your first monthly mortgage payments were.

If you would like a chat about where you sit in the current market, do not hesitate to give me a call on 01522 512 513 or drop me a message on social media.

To ensure ALL our clients get the absolute best experience, and a total marketing strategy as unique as their homes, we only list twenty properties per month, our October and November market appraisal slots are now available to book, we ensure that you are always a name and not just a number, with Walters.