Are you considering moving home in Lincoln over the next 6 to 12 months? You may be a Lincoln landlord deciding whether to grow your portfolio or sell off a few properties. Or you’re a Lincoln first-time buyer wondering if 2025 is the right time to move.

Understanding whether the current property market favours buyers or sellers is key to making the right call.

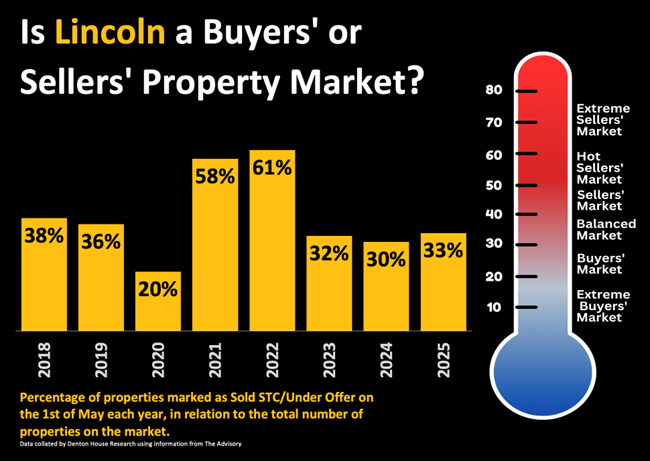

If you follow my regular Lincoln property updates, you’ll know one of the most reliable ways to assess the market is by looking at the percentage of homes marked as “Sold STC” or “Under Offer” compared to the total number of properties on the market.

Let’s show that in practice. For example, if say there are 500 properties on the market in a location, and 200 are under offer or Sold STC then 200 as a percentage of 500, gives us a sales percentage of 40%. It is this percentage that strongly indicates the local property market temperature and who holds the upper hand, i.e. buyers or sellers (or somewhere in between).

This percentage figure acts as a barometer for market conditions and can be analysed using this table:

- Extreme Buyers’ Market (0%-20%)

- Buyers’ Market (21%-29%)

- Balanced Market (30%-40%)

- Sellers’ Market (41%-49%)

- Hot Sellers’ Market (50%-59%)

- Extreme Sellers’ Market (60%+)

How Does Lincoln Compare?

Looking at historical data from the website, The Advisory, which has tracked this metric for years, we can observe some key trends for each May since 2018. (For this exercise, Lincoln is LN1 to LN6).

- In the years before the pandemic, in Lincoln’s market, the percentage figure was 38% in May 2018 and 36% in 2019.

- May 2020 was the mid-point in the first lockdown, the percentage dropped, as expected, to 20%.

- Demand rebounded sharply post-pandemic after the end of lockdown, and a year later, in May 2021, the percentage had risen to 58%.

- In May 2022, we were at 61%.

- However, with the fallout of the Liz Truss and Kwasi Kwarteng budget in late 2022 and increasing interest rates, by May 2023 it had settled to longer-term average levels of 32%. May 2024 saw similar levels at 30%.

- Now, we are in May 2025; we see the figure sitting at 33%.

These percentage figures are an average of the Lincoln postcodes (as noted above).

For interest, if I break the May 2025 figure into the individual Lincoln postcodes, it does actually tell an even more interesting story…

- LN1 – 28%

- LN2 – 39%

- LN3 – 29%

- LN4 – 29%

- LN5 – 34%

- LN6 – 36%

Look at the difference between the postcodes!

Implications for the Lincoln Property Market in Mid-2025

So, what does a 33% “Sold STC to total stock” ratio for Lincoln as a whole tell us?

It firmly places the Lincoln market at the lower end of a balanced market. That means neither side holds a dominant position, negotiations are nuanced, and buyers and sellers must bring their A-game.

For Lincoln Sellers:

We are now in a market where patience, presentation, and precise pricing are not optional but essential. With buyers enjoying more choice, it’s no longer enough to simply list your property and wait. The standout homes are the ones that are priced right from day one, have strong photography, floor plans, virtual tours, and are marketed properly both online and offline.

If you overprice your Lincoln home, expect it to linger on the market. And when a property lingers, price reductions follow, confidence drops, and you lose leverage in negotiations, often resulting in lower offers and a higher chance of fall-throughs before exchange. Getting it right from the start is more important than ever.

That said, the May 2025 interest rate cut brings a welcome tailwind. With the Bank of England shaving 0.25% off the base rate, mortgage rates are easing, and confidence is gradually returning to the buyer pool.

Here’s why that matters:

- First-time buyers in Lincoln now face lower monthly mortgage payments, which could help more of them step onto the ladder. That brings fresh energy into the market and supports a healthy chain from the bottom to the top.

- Home movers may use better fixed-rate deals to upsize or remortgage, releasing more stock and unlocking stalled chains.

- Buy-to-let investors, especially those operating in high-yield areas of Lincoln, may find the numbers starting to stack up again, particularly with net rental yields improving as borrowing costs fall.

- Buyer confidence is getting a boost. Rate cuts send a signal. They show the Bank wants to support stability and growth. That kind of message can turn ‘wait-and-see’ buyers into ‘let’s book a viewing’ buyers.

- This recent interest rate cut is not a one-off. It’s part of a series of interest rate reductions that began in late 2024. If the trend continues, momentum could build into summer and autumn. Mortgage lenders are already adjusting, with some two-year fixed-rate deals expected to dip nicely below 3.5% and five-year fixed-rate deals not far behind, before the end of the year.

For Lincoln Buyers:

This property market is more measured compared to the frenzied pace of 2021 and 2022. There’s room to breathe, to think, and in some cases, to negotiate. That doesn’t mean you can take forever or submit lowball offers on the best homes. Desirable properties are still attracting multiple viewers, but it does mean there are opportunities, particularly for those willing to look beyond the most in-demand streets.

Crucially, get your mortgage agreement in principle before you make an offer. It strengthens your hand massively. Sellers want certainty and being financially ready sets you apart from others.

Also, don’t be afraid to widen your search boundaries. Often, the best value is found just beyond the traditional hotspots.

My Final Thought:

With a new Government settling in and inflation softening, this interest rate cut could help cement the stable period the Lincoln property market has experienced in the last 18 months. It’s not boom territory, but it’s not bust either. It’s a continued return to something more balanced, considered, and sustainable.

If you’re thinking of moving in 2025 or just want to discuss your options, do not hesitate to give me a call on 01522 512 513 or drop me a message on social media.