In today’s Lincoln housing market, property market data isn’t just helpful – it’s essential. For Lincoln homeowners and landlords looking to buy or sell a home, understanding the latest Lincoln property trends, buyer behaviour, or house pricing movements is the difference between making a confident move and flying blind.

Data reveals where the market has been, where it’s heading, and how to position a home for success. It cuts through the noise, replaces guesswork with insight, and empowers better decisions. When used well, property data also becomes a seller’s compass and, subsequently, as a buyer, the edge as well – guiding your strategy, pricing, and timing in a property market that’s constantly shifting. In short, those who understand the data of the Lincoln property market (and the UK as a whole) move smarter. And those who ignore it risk being left behind.

The property market in Lincoln has seen a notable transformation in recent years.

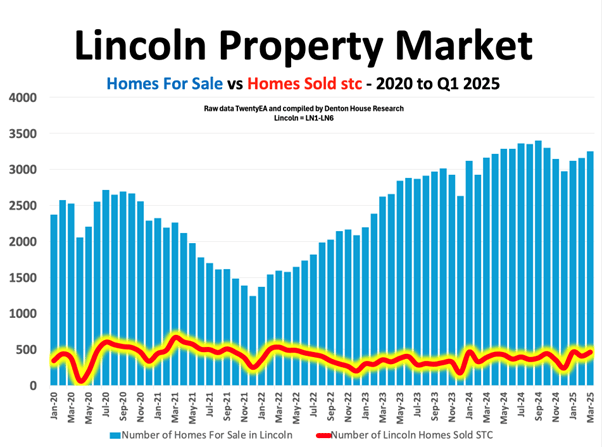

Each week in my blog posts, I use data to share my thoughts about the Lincoln property market. This week I am going to look at the number of Lincoln homes for sale on a month-by-month basis and then compare that with the volume of sales agreed (sold subject to contract—SSTC) on a month-by-month basis between January 2020 and March 2025.

From that information, I can show the direction of the local property market by calculating the percentage of Lincoln homes each month that have been selling.

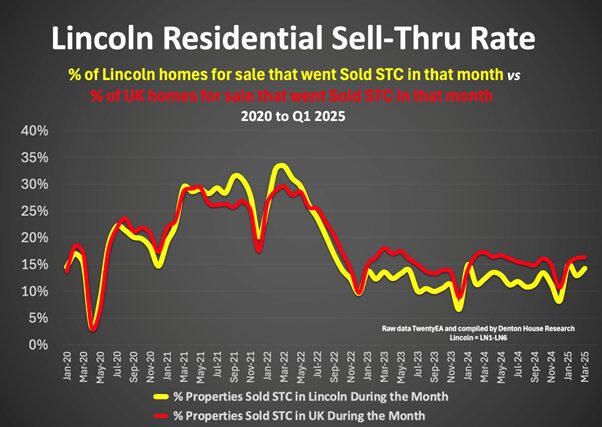

Since January 2020, an average of 17.7% of Lincoln homes on the market have sold STC each month

For some comparison, the lowest month since 2020, as expected, was the first month of lockdown, April 2020, when it was 3.1%. The highest month was March 2022, when it was 33.4%. In March 2025, that figure was 14.2%.

A closer look at this data reveals how the market has shifted and underlines the importance of sensible pricing—particularly now that the supply of homes has more than doubled since Easter 2022.

- In 2020, Lincoln had an average of 2,489 homes for sale, with 410 selling STC each month. That means 16.5% of Lincoln homes on the market found a buyer each month.

- In 2021, Lincoln had an average of 1,809 homes for sale, with 486 selling STC each month. That means 26.9% of Lincoln homes on the market found a buyer each month.

- In 2022, Lincoln had an average of 1,808 homes for sale, with 390 selling STC each month. That means 21.5% of Lincoln homes on the market found a buyer each month.

- In 2023, Lincoln had an average of 2,743 homes for sale, with 313 selling STC each month. That means 11.4% of Lincoln homes on the market found a buyer each month.

- In 2024, Lincoln had an average of 3,211 homes for sale, with 391 selling STC each month. That means 12.2% of Lincoln homes on the market found a buyer each month.

- In Q1 2025, Lincoln had an average of 3,178 homes for sale, with 444 selling STC each month. That means 14.0% of Lincoln homes on the market found a buyer each month.

The Evolution of the Lincoln Market (2020–2025)

Between January 2020 and February 2020, the Lincoln property market (covering LN1-LN6) experienced relative stability. Things changed dramatically with the arrival of COVID-19 in March 2020. The uncertainty led to a sharp drop in home sales during April and May of that year, as many buyers hesitated amid the economic upheaval.

However, following the lifting of the property market lockdown in May/June 2020, activity rebounded. The number of homes coming onto the market increased, as did the number of Lincoln homes selling.

This period was marked by strong demand despite reduced stock levels. The rush was fuelled by demand and the government’s stamp duty holiday, encouraging people to move.

As 2022 began, the market began returning to a more typical state. The number of homes coming onto the market increased, yet the number of Lincoln homes selling started to stabilise. This meant the number of homes for sale in Lincoln started to increase in 2022.

Then came two significant setbacks between late 2022 and early 2023.

Budget Fallout and Rising Interest Rates

The first blow came in autumn 2022 with the Truss government’s mini-budget, severely impacting buyer confidence. Over the months that followed, Lincoln’s average monthly sales fell. A recovery was underway by spring 2023, with sales rising. But this was short-lived—as interest rates climbed during summer 2023, buyer activity dipped once again, and sales fell.

The number of homes for sale continued to rise in 2024

In the early part of 2024, monthly house sales in Lincoln were quite healthy, yet the number of homes for sale was increasing. This jump in supply was due to several factors: sellers trying to cash in on still elevated house prices, a spike in new build activity, landlords selling up because section 24 taxation rules were beginning to bite, or simply more homes returning to the market after failing to sell previously.

Lincoln in Context: Comparing Proportions to the UK

A second graph, with a dark background, offers further insights by looking at the percentage of homes sold each month as a share of the total available stock.

The yellow line tracks Lincoln’s performance, while the red line shows the UK-wide equivalent.

From Easter 2020 through to early 2022, Lincoln saw a surge in the percentage of available homes going under offer, often hitting the low-mid 30% range. This supports the earlier data, showing that even though fewer homes were listed, those on the market were snapped up quickly.

Since 2022, that picture has changed. The proportion of homes selling compared to those available has declined steadily in Lincoln, now in the teens.

What Does This Mean for Lincoln People Looking to Move?

While buyer demand remains steady, the rise in available properties means there is a greater supply of homes to buy. Lincoln buyers have more choice.

For Lincoln homeowners looking to sell, this means competition is more intense than in previous years. Although buyers are still active, the sheer volume of homes on the market means sellers must be more strategic. A realistic asking price is now more important than ever.

An overpriced home risks being overlooked and left on the market. A well-priced property, on the other hand, stands a better chance of attracting attention and swiftly securing a buyer.

There’s also a practical reason to price sensibly. According to research by Denton House using TwentyEA data, if a property sells within 25 days of coming to market, there’s a 94% chance it will go on to complete. However, if it takes more than 100 days to agree on a sale, that figure drops to 56%, with a 44% chance of it falling through.

Lincoln’s housing market remains active, but sellers face a new reality: the number of available homes has doubled since mid-2022. To achieve a successful move, they must be attuned to the market and price their homes realistically.

Understanding local supply and demand – and adjusting expectations accordingly – is now critical. With more choices available to buyers, strategic pricing will separate the homes that sell from those that don’t.

If you want more data on the Lincoln property market, follow me on social media for weekly updates on our local property market. If you would like an informal, no-cost, and no-obligation chat about the Lincoln property market, whether you are a buyer or seller, feel free to drop me a line, send a message on social media or reach out to me by telephone on 01522 512 513.