Many Lincoln rental problems do not start with bad landlords or difficult tenants.

In Lincoln, as in many cities across the country, they usually start with good intentions and silence. Silence about rent reviews. Silence about maintenance. Silence about what happens when life changes.

Let me give you a scenario I see more often than people realise.

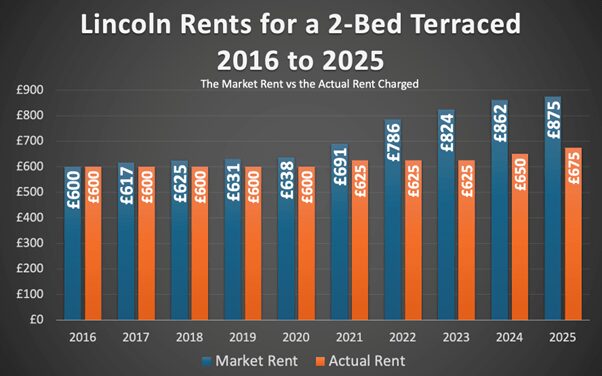

It’s a story of a tenant who moved into a two-bedroom terraced house in Lincoln in 2016. At the time, the rent was a very fair £600 per calendar month. It reflected the market, the condition of the home, and the local demand. Both landlord and tenant felt comfortable with the arrangement and the relationship was positive from day one.

By 2020, the monthly rent was still at £600, yet the market rate had risen to £638 (not much of a gap). Two years later (2022), the landlord had increased the rent to £625, yet the market rent was now at £786. In 2025, the rent was now £675, yet the market rent was £875, meaning there was a difference of £200 per month between the rent being paid and the market rent.

From the Lincoln landlord’s perspective, this rarely feels like a mistake at the time. The tenant pays reliably. They look after the home. There are no voids, no advertising costs, no awkward conversations. Increasing the rent feels uncomfortable, especially when the tenant has been loyal. Many landlords convince themselves they are doing the right thing by leaving things as they are.

From the tenant’s side, stability is everything. They built their household budget around that rent. Children settle into local schools. The house becomes a home rather than just a rental. They may notice the kitchen is dated or the bathroom could do with attention, but the rent feels fair for what they are getting, so they do not push too hard.

This is where the slow drift begins.

Rents in Lincoln since 2016 had risen by 45.8%, yet the landlord had only increased them by 12.5% …

… and because the rent no longer reflected the market, the property often stops receiving the level of investment it should. Small maintenance jobs get postponed. Bigger improvements are quietly shelved. Neither party feels quite justified in demanding more, because the arrangement has become unspoken and informal. The low rent becomes part of the compromise.

Then something changes.

The landlord’s circumstances change. It might be retirement, a change in job, a separation, or simply the need to release capital. The decision is made to sell. On paper, the property should be worth a certain figure. Though, with a sitting tenant paying £200 per month below market rent, the property will have a suppressed yield and, because the property needs cosmetic work, will not achieve the same price as one producing full market rent.

The Lincoln landlord now faces options they never planned for.

One option is to push the rent up sharply to improve the figures to improve the value of the buy-to-let home. Another option is to remove the tenant to sell vacant. Yet most landlords hesitate, hoping the problem will resolve itself. Eventually, pressure wins and the property goes onto the market at a discounted price (with a sitting tenant) and sells for less than it should have done.

At this point, the tenant believes they are out of the woods, yet nothing could be further from the truth.

The new landlord owner doesn’t have the emotional connection with that tenant, so brings the rent up themselves to a market level. When the rental increase lands, the jump can be by many hundreds of pounds a month. For a tenant who has shaped their life around the previous rent, this can be unmanageable and shocking.

What follows is rarely smooth. Negotiations fail. Notices are served. Stress levels rise. In the worst cases, it ends with legal action and forced moves. Nobody feels good about it, yet everyone feels trapped by decisions made years earlier by the first landlord.

The uncomfortable truth for both Lincoln landlords and tenants is that regular, modest rent reviews are usually the kindest option over time for everyone. Gradual increases allow tenants to adapt. Fair market rents allow Lincoln landlords to maintain properties properly. Most importantly, they reduce the likelihood of sudden sales that trigger upheaval for everyone involved.

This is not about squeezing tenants or defending bad practice. It is about recognising that pretending the market does not exist does not protect people, it just delays the consequences. Slow, predictable change is far easier to live with than sudden shocks.

Sometimes, what looks like fairness in the moment quietly plants the seeds of a crisis years down the line.

If you are a Lincoln Landlord thinking about selling and want an honest, evidence-based opinion on your Lincoln home’s actual market value, with no fluff, no pressure, and no nonsense, I would be delighted to help.

To ensure ALL our clients get the absolute best experience, and a total marketing strategy as unique as their homes, we only list twenty properties per month, our February and March market appraisal slots are now available to book, we ensure that you are always a name and not just a number, with Walters.