If you have ever thought about selling your Lincoln home, you will know how tempting it can be to stretch the asking price. After all, it is your biggest tax-free asset, and those extra few thousand pounds can feel like a sensible cushion. Yet in the Lincoln property market, ambition can sometimes cost more than it earns.

Over the past five and a half years, 14,161 Lincoln homeowners have come away from the market without selling. Many of them started with high hopes, only to find their homes withdrawn months later, unsold and unloved by buyers who had moved on to better-priced options.

The Data Behind the Frustration

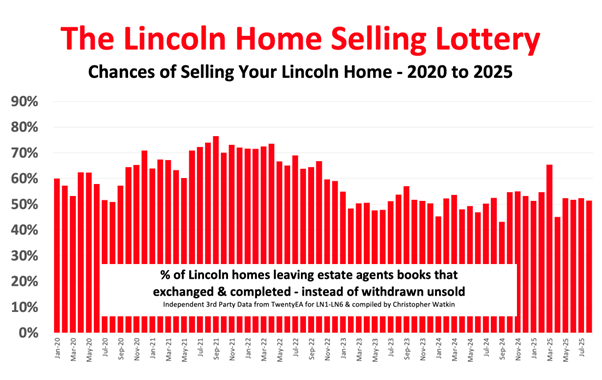

To understand how this has unfolded, let us look at what has actually happened across Lincoln (LN1-LN6) since 2020.

Before I start, a property sale is only legally binding when the home’s exchange and completion is finalised. Only then can the homeowner move. Therefore, I will only look at that.

- Of the 5,800 Lincoln properties that left estate agents’ books in 2020, 8% exchanged and completed. The other 40.2% of homeowners, a total of 2,331 homes, withdrew from the market unsold.

- Of the 6,666 Lincoln properties that left estate agents’ books in 2021, 7% exchanged and completed. The other 30.5% of homeowners, a total of 2,033 homes, withdrew from the market unsold.

- Of the 5,987 Lincoln properties that left estate agents’ books in 2022, 7% exchanged and completed. The other 33.3% of homeowners, a total of 1,992 homes, withdrew from the market unsold.

- Of the 5,681 Lincoln properties that left estate agents’ books in 2023, 3% exchanged and completed. The other 48.7% of homeowners, a total of 2,767 homes, withdrew from the market unsold.

- Of the 6,193 Lincoln properties that left estate agents’ books in 2024, 4% exchanged and completed. The other 49.6% of homeowners, a total of 3,074 homes, withdrew from the market unsold.

- Of the 4,238 Lincoln properties that left estate agents’ books in 2025 (so far), 7% exchanged and completed. The other 46.3% of homeowners, a total of 1,964 homes, withdrew from the market unsold.

So, over the last five and a half years, 14,161 Lincoln homeowners, who had spent months and months marketing their homes, only finished back where they started.

The main reason? Overvaluing.

Why Overvaluing Happens

When an estate agent visits your home, the valuation conversation can feel like a performance. You might hear one agent suggest £285,000, another £300,000, and then someone confidently says £325,000 without hesitation. It is flattering. It is exciting. It is often a trap.

Some Lincoln agents know precisely what number will win the instruction. They do not need to sell the home straight away; they only need to list it. In many cases, sellers are tied into sole agency contracts lasting 20 to 26 weeks, during which the price is quietly reduced until it reaches reality.

By that time, the most motivated buyers have already dismissed it.

The Consequences of an Inflated Asking Price on Your Lincoln Home

An overpriced property sits on the market longer than it should. Buyers start to ask questions. Why has it not sold? Is there something wrong with it? When a home lingers unsold, it develops a stigma. Even after the price is reduced, newer listings look fresher and attract more interest.

Independent data from Denton House Research and TwentyEA clearly shows the impact.

41.8% of UK homes that do go under offer (i.e., sale agreed/sold stc) do so within 28 days, and 70.9% of sales agreed, do so within 63 days.

And even if you do take longer to sell, the chances of actually moving drop like a stone. You see, UK homes that go under offer within 25 days of coming to the market have a 94% chance of subsequently exchanging and completing (i.e., you moving). Homes that take over 100 days to find a buyer subsequently see their success rate of getting to exchange and completion (i.e., move) drop to just 56%.

So, not only does overvaluing waste months, it also slashes the odds of your moving.

The Lincoln Property Market Has Changed

During late 2020 and all of 2021, the Lincoln market was fuelled by record demand, cheap borrowing, and pandemic relocation. Agents could list almost anything, and it would sell. That period created unrealistic expectations that still linger today.

However, since the middle of 2022, things have normalised. The average time on market has lengthened, price reductions have risen sharply, and buyers have regained negotiation power. The average property now sells for around 98.6% of its final asking price, compared with nearly 102% during the boom. That shift may not sound dramatic, but on a £500,000 home, it is almost £17,000 less in the seller’s pocket.

Overvaluing only widens that gap and reduces the chance your home will sell (and you move home).

Why Lincoln Estate Agents Keep Doing It

If overvaluing hurts homeowners and agents alike, why does it continue?

Pressure. Some larger estate agency firms still judge performance by listings, not completions. Staff bonuses are often linked to how many homes they put on the market, not how many they sell. As a result, the motivation shifts from accuracy to acquisition.

Telling a Lincoln seller what they want to hear wins more listings than telling them the truth. It also allows agents to appear “busy” in their marketing updates, even when most of their listings remain unsold.

It is a volume game, and the homeowner pays the price.

The Emotional Toll for Lincoln Homeowners

For many, overvaluing does more than delay a sale. It destroys plans. Lincoln families who wanted to upsize, Lincoln retirees looking to downsize, and couples moving for work have all been stuck in limbo. The months spent waiting, re-photographing, reducing, and re-listing add emotional fatigue on top of financial frustration.

By the time an offer finally appears (if it ever does), many homeowners are exhausted and willing to accept less to move on. Ironically, that often means they sell for less than they would have achieved if the home had been priced right from the beginning.

How to Avoid the Trap as a Lincoln homeowner

- Seek multiple opinions.

Invite at least two or three Lincoln agents to value your home. If one figure stands out as much higher, ask for evidence. Question: What percentage of their listings actually reach completion? Be very careful about tying yourself to a long sole agency agreement.

- Research sold data, not asking prices.

Use portals to check homes marked as “Sold Subject to Contract” or “Sold”. These reflect what buyers are really paying, not what sellers hope for.

- Track the local ratio of listings to sales.

If more than 40% of homes on the portals are sold STC, it is a seller’s market. If that figure falls below 30%, buyers have the upper hand.

- Work with an agent who values trust over flattery.

A good agent focuses on the end goal: your exchange and completion, not just a board outside your home. Avoid anyone asking for 20-to-26-week commitments. Confidence should come from competence, not contracts.

The Truth About Overvaluing

Overvaluing feels harmless at first. It sounds optimistic, even clever, bonus money in your back pocket. Yet in practice, it costs homeowners time, money, momentum, and, actually, you moving.

The data does not lie. Since January 2020, 20,404 Lincoln homeowners have sold and moved, yet 14,161 Lincoln homeowners have withdrawn from the market without selling, most due to unrealistic pricing. These are not failed homes. These are frustrated people.

If you are planning to sell, do not chase a fantasy number. Price your Lincoln home where the market is, not where you wish it were.

Remember, you only get one chance to make a first impression when your home hits the market. A realistic price attracts serious buyers quickly and gives you the best shot at moving successfully.

If you are thinking about selling and want an honest, evidence-based opinion on your Lincoln home’s actual market value, with no fluff, no pressure, and no nonsense, I would be delighted to help.

To ensure ALL our clients get the absolute best experience, and a total marketing strategy as unique as their homes, we only list twenty properties per month, our November and December market appraisal slots are now available to book, we ensure that you are always a name and not just a number, with Walters.